Written with Diane Loviglio

The User Experience Research team traveled to Sao Paulo and Recife, Brazil to study how the middle class thinks about and uses phones so we could design the best user experience for Firefox OS. We came back with much more: we identified four motivators that shape how middle classes in emerging markets think about themselves and plan for their futures. Getting excited? We certainly are… and this post is the first in a five part series about what we learned in Brazil.

Here we want to share our analysis process with you. Analysis is never easy because it’s never straightforward. You run off into interesting tangents, there are always more pages of transcripts to review, notes to parse, and of course, the ever-present problem of getting comfortable with ambiguity.

Here’s how we tackled these challenges and got great results:

1. Set up your analysis space

Setting up your space is crucial to getting in the analysis mode. It helps set the tone as well as prepares you for the work ahead.

We started by taking over a conference room and filling it with images from our trip. We printed photos that represented every participant including head shots, photos of their homes, their phones, and other items that best represented the participant and the interview. Each participant had their own foam core board that could be moved around the room or taken to outside meetings.

We also printed photos of Sao Paulo and Recife and pasted the walls and door so Mozilla employees walking by could get a sense of what Brazil is like as many of our colleagues have never been there.

2. Become a participant expert

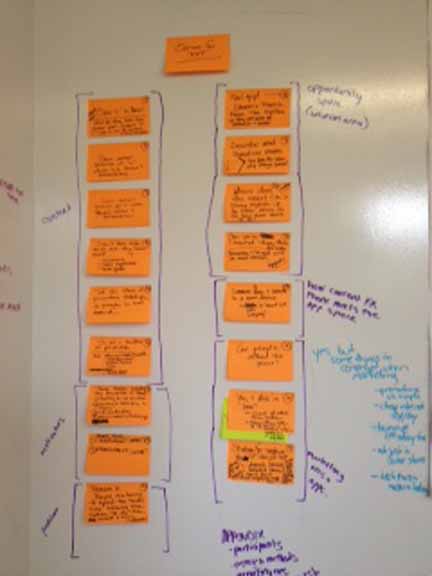

One way to jump start analysis when you have multiple people is divvy up the work and do it ahead of time. Assign each person doing analysis the task of becoming an expert on a set number of participants. They can read transcripts, review photos and/or video, and create a set of stickies (one idea per stickie) that represent the most important information from each participant’s interview.

When you get together for your first face-to-face analysis session you can start by sharing the stickies from each participant as a way to get the most important data out quickly.

Here’s us grouping the stickies into groups and then labeling those groups with Sylver Consulting — the design strategy & research firm we partnered with on this project.

3. Pull back to take stock

There’s only so far you can push data before you need to rest, review, and make sure you are going in the right direction. After two or three days of intense analysis, we recommend giving yourself a day to reflect and review. Take some time away from the project room, attend a few other meetings. So, when you return to the data you’ll be able to see patterns you couldn’t when you were deep in it.

We built ourselves a few visual organizational tools to help us do this review easily. We built a life-size grid with the participants, their phones, their carriers, what they were using their phones for, and what they wanted to be doing with their phones. This helped us review data quickly and became a reference for us through out the project.

4. Find the story

You may know the type of deliverables you are going to create — process maps, personas, what have you. But, you need to find the story — the thing that’s going to get your stakeholders riled up and bought in. That story needs to be identified during analysis, and fostered as you continue analysis. It doesn’t start out well-formed, but it usually includes the overlap of what users want/need and what the stakeholders want/need. In our case we needed to understand how Brazilians use their phones so we could build the best Firefox OS experience for them. We thought our story would focus on phone usage. However, our story ended up being about what motivates people in their lives. Mobile phones play a large, but supporting role in peoples’ motivations. But, if we can support the motivators, we will succeed at meeting their needs while providing a desirable and useful product.

What’s Up Next?

We have a lot of data from our trip to Brazil. Stay tuned for our next post on how Brazilians think about money. We’ll also have follow up posts about mobile phone purchasing and usage, and the big-daddy post — the four motivators.